Mobile Web Banking

You can bank with First Financial Bank with your smartphone. No app needed.

Learn to do more with our video help

Mobile App for iPhone

First Mobile app for iPhone® feature overview.

Mobile app for Android

First Mobile app for Android™ feature overview.

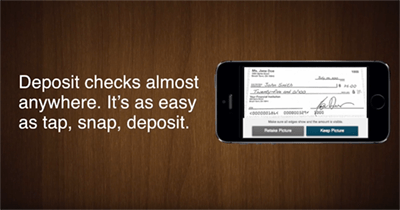

First mobile check deposit

Deposit checks to your First Financial Bank checking account directly from your mobile phone with the First Mobile app.

CardGuard

CardGuard by First Financial Bank is like an instant ON/OFF switch for your First Plus debit card.

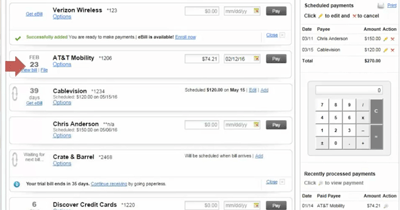

First Online Banking Bill Pay eBill Demo

Watch a short video on how you can use online banking to pay your bills.

First Online Banking Bill Pay Reminder Demo

Learn how to set up reminders for bill pay inside First Financial Bank’s online banking application.

First Online Banking Bill Pay Add Payee Demo

Learn how to set up payees inside the First Financial Bank online banking application.

If you prefer to read check out our FAQs

In the following sections you can see answers to some of our more frequently asked questions. Just click on the question to get a full description of what you need to know.

Bill Pay

Have the freedom to pay bills when, how and where you like.

Take advantage of our easy to use bill payment service available in First Online Banking and the First Mobile App. With just a few clicks you can:

- Pay an entire month’s worth of bills in less than 5 minutes.

- Send payments for almost any bill and any person—all on one screen.

- Save time, money and hassle with no checks to write. Log in and try it today!

You can pay all your bills in one place, so you only have to remember one username and password. Plus, you can better manage and control your finances by viewing your balance and paying your bills from the same website.

It typically is more secure to pay your bills within your online banking account. When submitting a payment online directly to a biller, you often are required to provide your financial account information to authorize a debit from your account—which may leave you vulnerable to security risks.

No, bill pay is FREE to all Online Banking customers.

It only takes minutes to log in and set up a new payee. You only have to enter payee information once. After a payee is set up, it is fast and easy to make future payments online.

To pay your bills online, simply add the companies and people you want to pay. We use this information to make the payments for your bill.

Next, add your bills, and then go to the Payment Center. The Pay Bills section lists all of the bills you’ve added in Bill Payment. To pay a bill, just enter a payment amount along with the date when you want the company or person to receive your payment. You can also select this date from the calendar.

Tips:

- When you enter an amount, Bill Pay automatically displays the earliest date you can select for the company or person to receive the payment in the Pay Date box. You can either accept this date or change it to a later one.

- The pay date is the date on which your payee will receive the payment.

- You can pay as many bills as you want at the same time from the Payment Center.

You can pay anyone in the United States that you would normally pay by check or automatic debit. Even if you don’t receive bills from the company or person you want to pay, you can still add the information we use to make payments. You can pay large companies and small companies, as well as individuals such as child care providers or family members.

When you pay a bill, Bill Payment sends the payment electronically whenever possible. If the company or person cannot receive electronic payments, Bill Payment prints a check and sends it to the address you provide when you add your bill.

You cannot use Bill Payment to pay any company or person with an address outside the United States or its territories. You can use Bill Payment to make state and federal tax payments and court-ordered payments; however, such payments are discouraged and must be scheduled at your own risk.

An electronic version of a bill, which is also called an e-bill, is a bill that you can view and pay online at the Payment Center. It typically contains the same information as a paper bill or statement.

We can receive electronic bills from hundreds of companies nationwide. When you add a company that can send electronic bills, you will see an eBill is available! message, followed by an Enroll Now link. Enter the information that your biller requires to set up your electronic billing service, and we send your request to the biller.

Some billers let you select options to automatically pay your electronic bills. You can decide to always pay the amount due or set limits for automatically paying the bill. You can also decide to pay the bill on the due date or schedule the payment for the earliest date available after you receive the bill.

With the CheckFree Guarantee, you can be assured that your electronic payments are safe and reliable. When your payments are processed through CheckFree, you are protected in the unlikely event of unauthorized transactions or processing delays so long as the payment is scheduled in accordance with the Terms and Conditions of the CheckFree service.

For most bills, your payment is delivered the next business day. If the payment requires a paper check, it can take four days for your biller to receive it.

If the payment is sent electronically, the money for the payment is withdrawn from your payment account on the pay date. If the company or person cannot receive electronic payments, Bill Pay prints a check and sends it to the billing address. For some checks, the money for the payment is withdrawn on the pay date. For others, the money is withdrawn when the company or person deposits or cashes the check.

You can log in to your online banking account to easily transfer funds from your savings to your checking account to cover payments. You also have the flexibility to schedule the payment to post when you know the funds will be available in your checking account.

In one year, by switching from paper to electronic billing, statements (eBills), and payments, the average American household would save 6.6 pounds of paper. Plus, if 20% of U.S. households switched to electronic bills, statements and payments, more than 1.8 million trees would be saved each year. (Source: Payitgreen.org)

If you should ever have a question about bill pay, you can send your inquiry through the secure messaging feature of Online Banking or call us at (800) 511-0045.

Mobile Text Message Banking

Text banking works on any phone that supports text messaging. After you enroll in First Mobile Banking, you’ll be able to text us anytime and we’ll text you back with the information you request.

- Log into First Online Banking.

- Locate and hover over Additional Services in the top blue navigation bar.

- Click Text Banking and Alerts.

- Enter you mobile phone number and click Activate.

- Enter the verification code sent to your mobile phone from First Financial Bank via text message and you are ready to use Mobile TXT banking.

- First Financial Bank text messages are sent from phone number 454-545.

- Mobile TXT Banking preferences cannot be set until the activation process is complete, including entering the

verification code.

- BAL — Primary account balance

- BAL ALL — All account balances

- BAL CHECK — Checking account balance

- BAL SAV — Savings account balance

- LAST — Last five transactions

- TRANS — Transfer funds to primary account

- HELP — Help keywords

- STOP — Deactivate service

Mobile Deposit

Conveniently deposit checks with our free Mobile Deposit feature inside the First Mobile app. Simply upload images of the front and back of your endorsed check to deposit funds directly into your checking account.

Any First Financial Bank customer who does not have a StartFresh account, and has been with the bank for at least 90 days.

Mobile Deposit offers the same level of security that you have with Online Banking. Check images are stored securely at the bank and not on your mobile phone.

Generally, the more recent versions of Apple® and Android™ devices with internet connectivity will work. Currently supported Android™ operating systems are Marshmallow 6.0, Lollipop 5.0, KitKat 4.4, Jelly Bean 4.1 to 4.3, and later. Android devices using an operating system below Jelly Bean 4.1 will not be able to use the First Mobile app.

Supported Apple® iOS® versions are always the last two made available by Apple®, currently iOS 7® and later.

Are you enrolled in First Online Banking? Have you installed the First Mobile app? Awesome! You’re all set to deposit checks from almost anywhere.

If you are not enrolled in First Online Banking, you can enroll online now, or using the First Mobile app. Our free First Mobile banking app is available for the iPhone®, iPad®, Android™ phones, Android™ tablets and Kindle Fire.* Can’t download via link? Look for the First shield when searching for First Financial Bank in your app store.

- Log in to the First Mobile app.

- Select Deposit Check.

- Sign the back of the check and write FOR DEPOSIT ONLY along with your account number.

- Take a picture of the front and back of the check.

- Select the account that will receive the deposit and

enter the amount. - Tap submit and you’ll get a confirmation message in seconds

- Place the check on a flat, well-lit surface. It’s best if the surface is dark enough that the check stands out

from the background. - Line up the check within the guides on your screen and tap the camera icon to take the picture.

- Review the check images to make sure they are readable. If not, retake the photos before sending them.

Your device will need a rear-facing camera in order to take a picture of checks you want to deposit. We recommend at least a 2-megapixel camera for best results.

Business checks, including paychecks, and personal checks.

After you submit the check images, you will receive a screen message on your device saying the deposit was received. If there is a problem with the deposit, you will receive a rejection message.

Yes, daily limits are displayed within the application.

Checks deposited before 6:00 p.m. Eastern Time Monday through Friday will appear in your online banking account the next business day. (A business day is any day the bank is open for business.)

Deposits made after 6:00 p.m. Eastern Time on Friday or anytime Saturday or Sunday will appear in your online banking account two business days later. If your deposit is rejected for any reason, you will be notified by email. Mobile check deposits are subject to review prior to acceptance.

Write Mobile Deposit along with the date of deposit on the check and keep it for at least two weeks in case verification is needed. After that, we recommend that you shred or otherwise destroy the check.

Non-sufficient funds (NSF) checks cannot be re-deposited using Mobile Deposit. Please present the check at any First Financial branch.

First Customer Account Line

The First Customer Account Line can provide you with immediate information about your First checking, savings, CD, IRA or loan accounts 24 hours a day.

To dial into this automated system, call or (800) 459-1672.

Checking and Savings Account Information

- Available balance

- Last six checks

- Interest information

- Ability to search for specific transactions by amount or check number

Loan Information

- Mortgage loans

- Installment loans

Funds Transfer

- Transfer funds to checking, savings or loan accounts

Certificate of Deposit and IRA Information

- Interest information

- Balance information

- Maturity date

Push Notifications not available on Amazon® Kindle Fire tablet. Apple® Touch ID®, Apple® Face ID® and Android™ Fingerprint ID available only on fingerprint enabled Apple® and Android™ devices. Smart watch apps available for enabled Apple® and Android™ devices only. Text and/or data charges may apply. Check with your wireless carrier. Mobile Deposit eligibility requirements: You must be a First Financial Bank customer for at least 90 days. StartFresh accounts are not eligible for Mobile Deposit. Mobile deposit only available on enabled Apple® and Android™ devices. Other terms and conditions apply.